In "Career Life", stock trading is not only a way for players to achieve wealth growth but also one of the most challenging aspects of the game. Today, the editor brings you a guide on how to choose stocks in Career Life. The stock market system in the game is full of fluctuations and risks, requiring players to have keen business acumen and rational decision-making skills. In the stock market, choosing the right stocks and formulating a reasonable investment strategy are key to success. This article will provide players with a stable stock trading route from multiple aspects such as stock selection, capital allocation, and risk control, helping you gain more wealth in the stock market of Career Life.

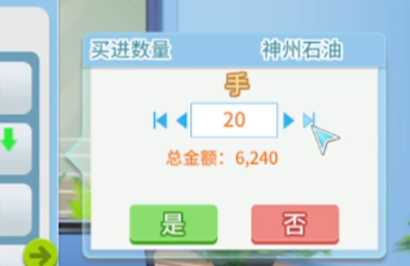

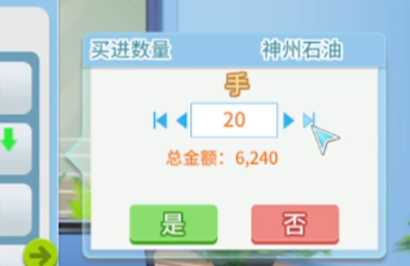

At the beginning of the game, players have limited funds. How to reasonably accumulate initial capital and avoid early losses is a challenge every newcomer must face. At this stage, investing in stocks with less volatility is a safer choice. Compared to those stocks with drastic price fluctuations, stable stocks can not only provide players with continuous small profits but also help them accumulate necessary stock market experience. It is recommended to prioritize investing in stocks that have long maintained low prices in the market, as these stocks have smaller fluctuations and are less affected by overall market volatility, making them suitable for beginners to test the waters. By continuously investing in these relatively stable stocks, players can steadily increase their capital reserves, laying the foundation for more aggressive investments later on.

Stock trading does not just rely on capital; improving your thinking value plays a crucial role in stock market investments. Thinking value determines a player's decision-making efficiency and analytical ability in the stock market. A high thinking value can help players better analyze stock trends and make more accurate judgments. Therefore, before operating in the stock market, it is suggested that players first improve their thinking value. By completing "thinking" tasks, players can enhance this attribute, thereby improving their ability to grasp the stock market situation. Especially when there are significant fluctuations in the stock market, a good thinking value can help players avoid blindly following the crowd and making impulsive decisions, thus maintaining clarity in a complex and ever-changing market.

During the stock trading process, over-concentrating investments in a single stock often increases risk. Therefore, reasonably diversifying investments is an effective strategy to reduce risk. When selecting stocks, players should avoid putting all their funds into one stock, but instead, allocate funds reasonably based on market conditions and their own financial situation. It is recommended to invest in 3 to 4 stocks, which can ensure the safety of funds while seeking opportunities among different stocks. Additionally, players need to adjust their strategies according to the overall trend of the stock market. For example, when the market is generally rising, they can increase investment in potential stocks, and when the market enters a volatile period, they should appropriately reduce the proportion of high-risk stocks to ensure the safety of capital.

In "Career Life", time reversal is a very important strategic tool that helps players preview future stock market trends, allowing them to make wiser decisions. Using the time reversal function wisely can help players grasp the pulse of the market at critical moments. However, the number of times time reversal can be used is limited, so players need to use it at the most needed moments. For those high-risk investment opportunities, time reversal can reveal the direction of the stock market in advance, helping players avoid significant losses. It is worth noting that although time reversal can provide some market predictions, players still need to consider other factors in the stock market, make cautious decisions, and avoid over-reliance on this mechanism.

The stock market is filled with countless temptations, especially during periods of sharp rises and falls, where players may be influenced by market sentiment and make overly impulsive decisions. However, rationality is the foundation of successful stock trading. In the stock market of "Career Life", players should avoid following the herd and buying stocks that have risen sharply in the short term. Even though these stocks may bring substantial returns in the short term, in the long run, they are highly volatile and risky, and investors are likely to suffer losses due to market corrections. Adhering to a steady investment strategy, avoiding the temptation of high-risk, high-return investments, rationally analyzing the true value of each stock, and allocating funds reasonably based on one's financial situation are important guarantees for successful stock trading.

In the stock market of "Career Life", reasonable stock selection and a clear investment route are the keys to accumulating wealth. By initially choosing less volatile stable stocks, enhancing market insight through improved thinking value, reducing risk through diversified investments, using time reversal to predict market trends, and maintaining rational decision-making, players can steadily progress in a market full of uncertainties. The stock market carries risks, and investments must be made cautiously. Only through continuous learning and practice can players stand out in the game's stock market and accumulate rich wealth.